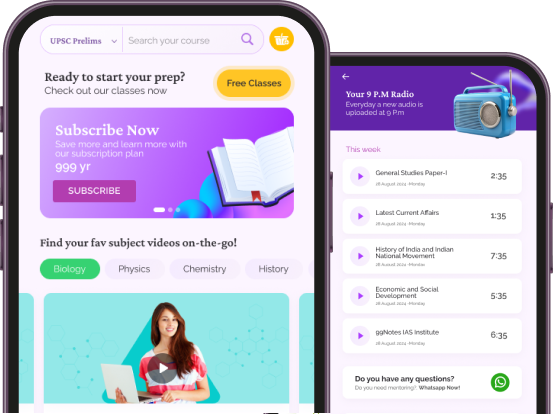

Download App to attend Free Live Classes

Download App

Download App

With reference to “Pradhan Mantri Garib Kalyan Anna Yojana”, consider the following statements:

1. This scheme can be availed by all the beneficiaries covered under the National Food Security Act (NFSA), 2013.

2. The schemes allows beneficiaries to choose between wheat and rice at the respective fair price shops.

3. The entire cost of the scheme is borne by the central government.

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

• This scheme can be availed by to all eligible ration cardholders or beneficiaries covered under the National Food Security Act (NFSA), 2013.

• PMGKAY provides 5kg of food grains to each family holding a ration card free of cost and the 5kg of subsidized food grain already offered through the Public Distribution System (PDS).

• Wheat has been allocated to 6 States/UTs,-Punjab, Haryana, Rajasthan, Chandigarh, Delhi, and Gujarat, and rice has been provided to the remaining States/UTs.

•There is no option for beneficiaries to choose between wheat and rice.

• It is a central sector scheme and all the expenditure is borne by Government of India.

In the context of recent trends in India’s GDP per capita, consider the following statements:

1. India’s GDP per capita has consistently increased over last decade.

2. Maharashtra has the highest GDP per capita among Indian States.

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

• You know that GDP per capita is calculated by dividing the GDP by the total population >> as you know that Maharashtra has a high population >> it is safe to assume that even though it is state with highest GDP >> it might lags behind some states with smaller population like Goa, Sikkim in GDP per capita>> eliminates statement 2.

• Goa is state with the highest GDP per capita (USD 5800) in India. Sikkim ranks second in the country. The NCT of Delhi follows Sikkim at third place with a GDP per capita of USD 4600.

Consider the following statements:

1. Extra-Long Staple (ELS) cotton accounts for more than half of total cotton produced in India.

2. India is the world’s largest exporter of Extra-Long Staple (ELS) cotton.

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

• ELS denote a category of cotton fibre with a staple length between 32-36mm.

•In India, major cotton produced is 26-30mm (almost 80%is 29mm) which is considered medium- grade

• In 2022 >> India’s total production is around 34 million bales of cotton. In that ELS cotton accounts for just around half a million.

• The industry’s requirement of extra-long staple cotton is around 20 lakh bales while the country produces only five lakh bales and heavily depends on imports of superior quality extra-long staple cotton..

• It is this import of ELS Cotton that the Budget announcement seeks to cut through boosting domestic production.

• Egypt, U S, and Australia are the largest producers of ELS cotton.

“Effective Capital Expenditure” of the Central Government is calculated by:

Answer Given: SKIPPED

Explanation:

• Finance Minister announced that ‘Effective Capital Expenditure’ of the Centre is budgeted at 13.7 lakh crore, which will be 4.5 per cent of GDP. Aspirants are recommended to have a clear understanding on such budgetary terms

• Capital expenditure taken together with the provision made for creation of capital assets through Grants-in-Aid to States gives ‘Effective Capital Expenditure’

With reference to Indian Institute of Millets Research, consider the following statements:

1. It is located in Hyderabad

2. It operates under the aegis of Indian Council of Agricultural Research (ICAR)

3. It conducts agricultural research on millets breeding

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

• IIMR operates under the aegis of Indian Council of Agricultural Research (ICAR).

• It conducts agricultural research on Millets breeding, improvement, and pathology and value addition.

• ICAR -IIMR performs crop improvement research, using conventional as well as methods derived from biotechnology, on the following crops: Sorghum, pearl millet, finger millet, foxtail millet, • • little millet, barnyard millet.

“Agriculture Accelerator Fund”, introduced in the Union Budget 2023-24, aims to:

Answer Given: SKIPPED

Explanation:

An Agriculture Accelerator Fund will be set-up to encourage agri startups by young entrepreneurs in rural areas. The Fund will aim at bringing innovative and affordable solutions for challenges faced by farmers. It will also bring in modern technologies to transform agricultural practices, increase productivity and profitability

Upper Bhadra project, a major lift irrigation scheme widely discussed in news, is located in:

Answer Given: SKIPPED

Explanation:

About Upper Bhadra project: Upper Bhadra projectis a major lift irrigation Scheme under implementation in the central region of Karnataka. Major objective is to provide sustainable irrigation facility in kharif season. It will divert 29.90 tmcft of water from Tunga and Bhadrato irrigate central Karnataka areas (Tungabhadra River is formed by the confluence of the Tunga River and the Bhadra River) In 2022, Central government gave national project status to “Upper Bhadra Project”.

Which of the following items are included in Harmonised Master List of Infrastructure sub-sectors?

1. Shipyards

2. Data centres

3. Affordable housing

4. Solid Waste Management

How many of the items given above is/are correct?

Answer Given: SKIPPED

1. Shipyards

2. Data centres

3. Affordable housing

4. Solid Waste Management

Sickle Cell Anemia is a disease condition in which there is a:

Answer Given: SKIPPED

Explanation:

•Sickle Cell Anemia is a group of inherited red blood cell disorders. Red blood carries oxygen to all parts of the body.

• Healthy red blood cells are round, and they move through small blood vessels to carry oxygen to all parts of the body.

• In someone who has this disease, the hemoglobin is abnormal, which causes the red blood cells to become hard and sticky and look like a C-shaped farm tool called a “sickle.”

• The sickle cells die early, which causes a constant shortage of red blood cells. Cause:

•SCD is a genetic condition that is present at birth. It is inherited when a child receives twogenes—one from each parent—that code for abnormal hemoglobin.

• Prevention:

• Management of the disease is focused on preventing and treating pain episodes and other complications.

• Prevention strategies include lifestyle behaviors as well as medical screening and interventions to prevent complications.

With reference to Municipal Bonds, consider the following statements:

1. Such bonds can be listed on stock exchanges

2. They cannot be issued with a maturity period of above one year

3. They can be issued either through public offer or on private placement basis

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Recently bonds issued by the Lucknow Municipal Corporation (LMC) got listed on the Bombay Stock Exchange. It’s the ninth city in the country to raise capital through municipal bonds Such bonds generally come with a maturity period of three years. However there are short- term bonds that have a maturity of one year and long-term bonds that have a maturity of up to ten years. Under Municipal Debt Regulations, issuers are allowed to issue municipal debt securities either through public offeror on private placement basis. Municipal debt securities issued on private placement basis that are proposed to be listed are governed by the provisions of Municipal Debt Regulations Public issue: When an issue / offer of municipal debt securities is made to investors/ public through an issue of offer document, it is called a public issue. Private placement: When an issuer makes an offer of municipal debt securities to a select group of persons (not exceeding two hundred excluding qualified institutional buyers in a financial year), through placement memorandum, it is called a private placement.

Aspirational Blocks Programme is set up under the:

Answer Given: SKIPPED

Explanation:

About the scheme:

•The Aspirational Blocks Program is on the lines of the Aspirational District Program that was launched in 2018.

• ABP aims to improve the performance of blocks lagging on various development parameters. This will enable holistic development in those areas that require added assistance.

•The program will cover 500 blocks across 31 states and Union Territories initially. Over half of these blocks are in 6states—Uttar Pradesh, Bihar, Madhya Pradesh, Jharkhand, Odisha and West Bengal.

• NITI Aayog in partnership with the states will release a quarterly ranking of these blocks based on their performance on development indicators covering sectors such as health, education and nutrition among others.

With reference to “Lab Grown Diamonds (LGD) ?, consider the following statements:

1. India is a net importer of lab-grown diamonds.

2. Production of lab-grown diamonds have lower carbon footprint as compared to natural diamonds.

3. Lab-grown diamonds have high thermal conductivity, but negligible electrical conductivity.

How many of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

• India net exporter of Lab Grown diamonds and we recently witnessed a sharp rise in lab- grown diamond exports

• The USA accounts for around 67% of India’s exports followed by Hongkong with a share of 14%.

• Currently, India contributes around 15% of the global production of lab-grown diamonds for which it is presently self-sufficient.

• Mining for natural diamonds involves extracting them from deep within the earth's crust, which requires significant energy usage and emits large amounts of greenhouse gases.

• Additionally, the transportation of these diamonds from the mines to the processing centers and then to retailers and consumers further adds to their carbon footprint.

? In contrast, lab-grown diamonds are produced in a controlled laboratory environment which typically requires less energy and emits fewer greenhouse gases than mining natural diamonds. While some energy is still required to create lab-grown diamonds, the overall carbon footprint of the production process is much lower than that of natural diamonds.

•Pure synthetic diamonds have high thermal conductivity, but negligible electrical conductivity.

• This combination is invaluable for electronics where such diamonds can be used as a heat spreader for high-power laser diodes, laser arrays and high-power transistors.

Case details of which among the following courts are available in the National Judicial Data Grid (NJDG)?

1. Supreme Court

2. High Courts

3. District and Subordinate Courts

Select the correct answer using the code given below:

Answer Given: SKIPPED

Explanation:

National Judicial Data Grid (NJDG) is a database of orders, judgments and case details of 18,735 District & Subordinate Courts and High Courts created as an online platform under the eCourts Project.

Data is updated on a near real-time basis by the connected District and Taluka courts. It provides data relating to judicial proceedings/decisions of all computerized district and subordinate courts of the country.

All High Courts have also joined the National Judicial Data Grid (NJDG) through web services, providing easy access facility to the litigant public.

Case data is available on NJDG for both civil and criminal cases with the ability to perform drill-down analysis based on the age of the case as well as the State and District.

Which of the following statements are correct regarding Viability Gap Funding (VGF) Scheme?

1. Grants under the scheme will be available only for infrastructure projects.

2. The total grant under the scheme does not exceed 20% of the total project cost, irrespective of the sector in which investments are made.

3. PPP projects proposed by State Governments are not eligible for funding under the scheme.

Select the correct answer using the code given below:

Answer Given: SKIPPED

Explanation:

• Support under this scheme is available only for infrastructure projects where private sector sponsors are selected through a process of competitive bidding. Generally the total VGF under the scheme does not exceed 20% of the total project cost. However projects in areas like wastewater treatment, solid waste management, health, water supply and education, could get 30% of the total project cost from the Centre. Separately, pilot projects in health and education, with at least50% operational cost recovery, can get as much as 40% of the total project cost. . The PPP projects proposed by the Central Ministries, State Government or Statutory Authorities (like Municipal Authorities and Councils), which own the underlying assets >> are eligible for funding Moreover to be eligible for financing under the scheme, the PPP projects should: Be implemented by a Private Sector Company to be selected by the Government or a statutory entity through a transparent and open competitive bidding process Provide a service against payment of pre-determined tariff or user charge

The "Green Credit Programme", proposed in Union Budget 2023-24, to incentivize environmentally

sustainable and responsive actions by companies, individuals and local bodies, will be notified under:

Answer Given: SKIPPED

Explanation:

• FM announced that >> for encouraging behavioural change, a Green Credit Programme will be notified under the Environment (Protection) Act.

• This will incentivize environmentally sustainable and responsive actions by companies, individuals and local bodies, and help mobilize additional resources for such activities.

With reference to “PM PRANAM”, consider the following statements:

1. It aims to promote the use of urea by farmers.

2. There will be no separate budget for the scheme.

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

PM PRANAM Scheme stands for PM Program3 for Restoration, Awareness, Nourishment, and Amelioration of Mother Earth The main objective of the scheme is to discourage chemical fertilizer usage and promote sustainable agriculture practices. It helps to bring down the subsidy burden of the government on chemical fertilizers. It is also in line with the government’s focus to promote alternative fertilizers or the balanced use of fertilizers There will be no separate budget for the PM PRANAM scheme. It will be financed through the –“savings of existing fertilizer subsidy” provided by the department of fertilizers under various schemes. 50% of subsidy savings will be passed on as a grant to the state that saves the money 70% of the grant provided under the scheme can be used for asset creation related to the technological adoption of alternate fertilizers and alternate fertilizer production units at the village, block and district levels. The remaining 30% grant money can be used for rewarding and encouraging farmers, panchayats, farmer producer organizations and self-help groups that are involved in the reduction of fertilizer use and awareness generation. The government would compare a state’s reduction in urea in a particular year to its average consumption of urea during the last three years.

Which of the following statements is/are correct regarding vehicle scrappage policy of India?

1. As per the policy, private passenger vehicles are not allow to renew their registration after 15 years.

2. The policy is not applicable to commercial vehicles.

Select the correct answer using the code given below:

Answer Given: SKIPPED

Explanation:

Union Budget 2023-24 allocated funds to scrap old vehicles of the Central Government. Budget also announced that States will also be supported in replacing old vehicles and ambulances.

With reference to MISHTI program? recently launched by the government, consider the following statements:

1. It will facilitate mangrove plantation along India's coastline and on salt pan lands.

2. The program utilizes CAMPA Fund for its implementation.

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Budget 2023-24 launched a new scheme named MISHTI (Mangrove Initiative for Shoreline Habitats & Tangible Incomes) for mangrove afforestation. Aspirants are advised to look into its salient features. Statement 1 >> Correct

The program aims for mangrove plantation along the coastline and on salt pan lands. Statement 2>> Correct

The Budget states that MISHTI will be implemented through convergence between the MGNREGS (Mahatma Gandhi National Rural Employment Guarantee Scheme), CAMPA (Compensatory Afforestation Fund Management and Planning Authority) Fund and other sources.

With reference to “Vibrant Villages Program”, consider the following statements:

1. The scheme will provide funds for the development of essential infrastructure in all the states with international land border.

2. The scheme will be subsumed under the Border Area Development Program

3. Successful implementation of this program helps to retain the population in the border areas

How many of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

• While Border Area Development Programme is focused only on development of infrastructure along border areas, VVP has wider objectives from promotion of tourist centres creating livelihood opportunities, road connectivity, decentralized renewable energy, direct-to-home access for Doordarshan and educational channels etc. Statement 1>> Incorrect

• The scheme will provide funds for the development of essential infrastructure and the creation of livelihood opportunities in 19 districts and46 border blocks across four states and one UT along the northern land border of the country. It also seeks to develop growth centers on the “Hub and Spoke Model” through the promotion of social entrepreneurship, the empowerment of youth and women through skill development and entrepreneurship, leveraging the tourism potential, and the development of sustainable

eco-agribusinesses. Statement 2>> Incorrect

• The Vibrant Villages Programme will not overlap with the Border Area Development Programme. Statement 3 >> Correct

•The key outcomes of the scheme are to encourage people to stay in their native locations in border areas, reversing the outmigration from these villages, adding to improved security of the border.

Consider the following statements:

1. GIFT City in Gujarat is the only approved IFSC (International Financial Services Centre) in India.

2. All the transactions undertaken by the units in IFSC should be in foreign currency.

3. Reserve Bank of India does not have any regulatory jurisdiction over the banking transactions carried out in the GIFT City.

How many of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

•An IFSC caters to the customers outside the jurisdiction of domestic economy Such centers deal with the flow of finance, financial products, and services across the borders.

•IFSC as envisaged under the Indian context “is a jurisdiction that provides financial services to non-residents and residents (Institutions), in foreign currency other than Indian Rupee (INR)”

•IFSC is set-up to undertake financial services transactions that are currently carried on outside India by overseas financial institutions and overseas branches/ subsidiaries of Indian financial institutions. GIFT City is India’s only approved IFSC located in the capital city of Gandhinagar,

-State of Gujarat.

•All the transactions undertaken by the units in IFSC should be in foreign currency. Statement 3>> Incorrect

-The following are the regulating bodies for various financial services:

•Banking: Reserve Bank of India (RBI)

•Insurance: Insurance Regulatory and Development Authority of India (IRDAI)

•Capital markets (including Asset Management): Securities and Exchange Board of India (SEBI)

In the context of digital payment ecosystem in India, consider the following statements:

1. Number of digital transactions has been consistently increasing in India over the last five years

2. In terms of volume of transactions, UPI contributes largest share in the total digital transactions in India

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

• You may be aware of revolutionary transformation happening in India’s Digital Payment Ecosystem over the last few years, thanks to the new interfaces (like UPI), government push etc. Moreover demonetization of 2017 and COVID pandemic had also accelerated this push. Hence it is very likely that statement 1 could be true.

• As you know that UPI has become most popular tools in the country for carrying out digital transactions, and question is asked in terms of ‘number of transactions’ >> one could guess that statement 2 could be true.

• As per Economic Survey 2022-23>> the Unified Payment Interface (UPI) accounted for 52% of the total 8,840 Cr financial digital transactions in the financial year 2021-22 (FY22).

In the context of Union Budget 2023-24, consider the following statements:

1. Budget sets fiscal deficit limit of the States at 7% of GSDP.

2. Budget proposed to provide a “fifty-year interest free loan” to states to meet their revenue deficit

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

• In Budget 2023-24, the Finance Minister stated that the States will be allowed a fiscal deficit of 3.5 per cent of GSDP of which 0.5 per cent will be tied to power sector reforms.

• The entire fifty-year loan to states has to be spent on capital expenditure within 2023-24. Most of this will be at the discretion of states, but a part will be conditional on states increasing their actual capital expenditure. Parts of the outlay will also be linked to, or allocated for, the following purposes:

• Scrapping old government vehicles,

• Urban planning reforms and actions,

• Financing reforms in urban local bodies to make them creditworthy for municipal bonds,

• Housing for police personnel above or as part of police stations,

• Constructing Unity Malls,

• Children and adolescents’ libraries and digital infrastructure

• State share of capital expenditure of central schemes

Which of the following statements is not correct regarding “DigiLocker”?

Answer Given: SKIPPED

Explanation:

• Open source software (OSS) is software that is distributed with its source code, making it available for use, modification, and distribution with its original rights. Major examples are Linux, Mozilla Firefox

• Promoting OSS is a part of GovTech 3.0.It is focused on Open Digital Ecosystems (ODEs), the underlying philosophy suggests that the government should focus on creating the “digital commons”.

• Government platforms such as DigiLocker, Aarogya Setu, CoWIN, DIKSHA are built on open source software (OSS) Option B >> Correct

• A cloud platform refers to the operating system and hardware of a server in an Internet-based data center

• DigiLocker user will get a dedicated cloud storage space that is linked to your Aadhaar number.

Option C>> Correct

• DigiLocker is completely safe and secure to use. To secure user’s privacy it adopt following practices:

• DigiLocker follows standard software development practices of uniform coding standards, guidelines and reviews.

• DigiLocker uses 256 bit secure socket layer (SSL) Encryption for information transmitted during any activity.

Option D >> Incorrect

• There are two types of documents in one’s Digi-Locker account

• Issued documents are e-documents issued by various government agencies in electronic format directly from the original data source and the URI (link) of these documents is available in the issued documents section of DigiLocker

• Uploaded documents are uploaded by user directly to the platform.

Russian-Ukraine conflict had led to a worldwide surge in inflation. Which of the following were the outcomes of such inflationary pressure?

1. Central banks across economies hiked interest rates

2. Indian Rupee depreciated against the US dollar

3. Widening of the Current Account Deficits (CAD) in net importing economies, including India

Select the correct answer using the code given below:

Answer Given: SKIPPED

Explanation:

• Russian-Ukraine conflict leading to a worldwide surge in inflation.

• Then, the central banks across economies led by the Federal Reserve responded with synchronized policy rate hikes to curb inflation.

• The rate hike by the US Fed drove capital into the US markets causing the US Dollar to appreciate against most currencies (including India).

• This led to the widening of the Current Account Deficits (CAD) and increased inflationary pressures in net importing economies.

World Economic Outlook, which includes the estimates and forecasts for global output growth and

inflation, is published by:

Answer Given: SKIPPED

Explanation:

• The World Economic Outlook (WEO) is a comprehensive report published twice a year by the International Monetary Fund (IMF).

• It includes the IMF's estimates and forecasts for global output growth and inflation as well as for real gross domestic product (GDP) growth, consumer prices, current account balances and unemployment in the fund's 190 member countries, grouped by region and development status. The WEO also includes several chapters on selected pressing economic issues.

• The data is drawn from IMF representatives' consultations with member countries, and is included in the WEO database. The WEO is usually published in April and October. Major reports published by International Monetary Fund Major reports published by World Bank

1.World Economic Outlook

2.Global Financial Stability Report

3.Fiscal Monitor

1.Ease of Doing Business

2.World Development Report

3.Global Economic Prospect (GEP)

Report

4.Remittance Report

5.Ease of Living Index

6.Universal Health Coverage Index

In the context of Non-Financial Sector Debt of India, consider the following statements:

1. India’s non-financial sector debt to GDP ratio has increased considerably since Global Financial Crisis of 2008.

2. India’s household debt to GDP ratio is considerably lower than Government debt to GDP ratio.

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

• Non-financial sector debt of most economies has increased considerably as a percentage of GDP since 2008 when the global financial crisis struck.

• India is, however, one of the few countries whose debt burden has declined over this period, mainly because of the country’s banking sector balance sheet clean-up and the corporate sector’s deleveraging exercise undertaken during the last decade.

• Yet, an increase in the general government debt burden in India has attracted much attention, even as systemic risks of a financial breakdown are concentrated in other parts of the world. Please note: Debt of the Indian Non-Financial Sector as a whole has gone up from 162.3% of GDP to 170.3% of GDP between 2017 and June 2022. Rising household and government debt led to the rise of core debt in the Indian Non-Financial Sector.

• Indian household debt is 36% of GDP in 2022

• Debt of the Indian government is a worrisome 82.4% of GDP in 2022.

• In absolute terms, the government debt has gone up from $1.8 trillion to $2.6 trillion, while for households it zoomed from $898 billion to $1.12 trillion in the last 5 years.

In the context of India’s external debt scenario, consider the following statements:

1. Majority of India’s external debt is denominated in the US dollar

2. Share of short-term debt in India’s total external debt is higher than the share of long term debt

3. Sovereign External Debt accounts for more than half of India’s total external debt

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1>> Correct

• India’s external debt is at USD 610.5 billion as of 2022

• More than 55% of India’s external debt is denominated at US Dollar.

Statement 2>> Incorrect

• In that >> share of long-term debt is around 80%per cent and share of short-term debt is 20%

Statement 3 >> Incorrect

• Sovereign External Debt is the government (both center and states combined) owned external debt

• India’s SED is lower than non-SED

• As of 2022, Sovereign External Debt (SED) amounted to USD 124.5 billion and Non-SED is at USD486.0 billion

“Baltic Dry Index”, often mentioned in news is related to which of the following?

Answer Given: SKIPPED

Explanation:

• The Baltic Dry Index (BDI) is a shipping and trade index created by the London-based Baltic Exchange.

• It measures changes in the cost of transporting various raw materials, such as coal and steel. The BDI is often viewed as a leading indicator of economic activity because changes in the index reflect supply and demand for important materials used in manufacturing.

• Members of the exchange directly contact shipping brokers to assess price levels for given shipping paths, a product to transport, and time to delivery or speed.

• The Baltic Dry Index is a composite of four sub-indices that measure different sizes of dry bulk carriers or merchant ships: Capesize, Panamax, Supramax, and Handysize.

In the context of external trade of India, consider the following statements:

1. Over the last few years, India’s share of import in GDP has never been less than share of export in GDP

2. India’s share of export in global trade is nearly 10 percent

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

As of 2022, share of India’s export in global trade is at 2.1%.To compare the share of china’s export is more than 13%.

Consider the following statements:

1. Over the last decade, Gross Fixed Capital Formation (GFCF) of India as percentage of GDP shows an upward trend.

2. In India, Industry sector contributes largest share to the Gross Fixed Capital Formation (GFCF)

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 >> Incorrect

• Since a peak in 2007-2008 with a GFCF-GDP ratio of 36% >> it has been showing a downtrend till 2016-17. However an uptick is evident since then >> and the GFCF-GDP ratio is 32% in 2022

Statement 2 >> Incorrect

• The table below shows the distribution of GCF by agriculture, industry and services (columns 1 to 3); within services transport (column 3.1) and within transport, roads (the single largest expenditure item; column 3.1.1).

The term "Pent-up demand? is used by economists to describe:

Answer Given: SKIPPED

Explanation:

What is Pent-up demand?

• Pent-up demand refers to a situation where demand for a service or product is unusually strong.

• Economists generally use the term to describe the general public's return to consumerism following a period of decreased spending.

• The idea is that consumers tend to hold off making purchases during a recession, building up a backlog of demand that is unleashed when signs of a recovery emerge.

Consider the following statements:

1. Foreign Exchange Reserves of India is higher than United States, but lower than China

2. India’s Foreign Exchange Reserves have been consistently on decline over the last five years

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 ; Correct

Statement 2 ; Incorrect

Consider the following statements regarding Special Drawing Rights (SDR):

1. The allocations of SDRs to member countries are in proportion to their IMF quotas

2. Other than member countries, SDRs can be used by individuals and corporations

3. The value of the SDR is based on a basket of currencies of all IMF member countries

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1>> Correct

•The IMF may allocate SDRs to member countries in proportion to their IMF quotas -the maximum amount of financial resources that it is obligated to contribute to the fund.

Statement 2>> Incorrect

• At present, SDRs are not used for transactions by Individuals and Corporations. It is widely used in international transactions, including export quotas in the IMF member sand the number of official reserve assets which were in their own currencies. It is also traded on the Foreign Exchange Market.

Statement 3>> Incorrect

• The value of the SDR is based on a basket of five major currencies only—the US dollar, the euro, the Chinese renminbi (RMB), the Japanese yen, and the British pound sterling.

Which among the following tools are used by RBI for increasing money supply in the economy?

Answer Given: SKIPPED

Explanation:

Option A >> Incorrect

• When RBI sells government securities in the open market >> RBI is sucking money from the market >> which reduces money supply in the economy.

Option B >> Incorrect

• Increasing the rate at which banks borrow from RBI makes it difficult for banks to borrow from RBI, thereby increasing the general borrowing rates in the economy. Higher the borrow rate >> lower borrowings >> hence less money supply in the economy.

Option D >> Incorrect

• Increasing the Reverse Repo Rate makes the commercial banks to deposit more money

In the context of Indian economy, consider the following statements:

1. Over the last decade, share of private consumption in India’s GDP is always above 50%

2. Government final consumption expenditure includes salaries provided to public servants

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 >> Correct

Statement 2; Correct

Government final consumption expenditure includes all government current expenditures for purchases of goods and services (including compensation of employees)

With reference to growth rate of India’s GDP, consider the following statements:

1. India’s real GDP growth rate has never been negative over the last five years

2. Recently growth rate in Agriculture GDP has touched double digit for the first time in India’s history

3. Growth rate in Industrial Sector has never crossed 10% mark in recent years

How many of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 >> Incorrect

Statement 2 and 3 >> Incorrect

Which of the following statements are correct regarding “Purchasing managers Index” ??

1. It is published only for the manufacturing sector.

2. It is published by National Statistical Organisation (NSO).

Select the correct answer using the code given below:

Answer Given: SKIPPED

Explanation:

Statement 1>> Incorrect

• The Purchasing Managers' Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors.

• It consists of a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting.

• The PMI is based on five major survey areas: new orders, inventory levels, production, supplier deliveries, and employment.

Statement 2>> Incorrect

•It is compiled and released monthly by the Institute for Supply Management (ISM).

In the context of legal framework related to corporate offences, consider the following statements:

1. Recently economic offences under the Companies Act of 2013 are completely de-criminalized

2. State Governments can assign investigation into the affairs of a particular company to the Serious Fraud Investigation Office

3. The provisions of the Companies Act 2013 provide for establishment of Special Courts

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 >> Incorrect

• Civil liabilities are introduced instead of criminal liability for dealing with simple defaults that do not involve fraud or where the nature of the lapse is purely procedural. All economic offences are NOT decriminalized.

Statement 2 >>Incorrect

• Central Government established Serious Fraud Investigation Office to investigate frauds relating to a Company.

• It is Central Government, which is empowered to assign the investigation into the affairs of a company to the Serious Fraud Investigation Office.

Statement 3>> Correct

•The provisions of the Companies Act 2013 provide for establishment of Special Courts.

• Offences under the Companies Act 2013 shall be tried only at Special Courts.

• Complaints can be filed by Shareholder, ROC or any officer authorized by Central Government; however the court may take cognizance of offences relating to issue and transfer of securities and non-payment of dividend, on a complaint in writing, by a person authorized by the Securities and Exchange Board of India.

In the context of Annual Periodic Labour Force Survey 2020-21, consider the following statements:

1. Labour Force Participation Rate have improved for both females and males in India

2. Labour Force Participation Rate have improved in both rural and urban areas

Which of the statements given above is/are correct?

Answer Given: SKIPPED

1. Labour Force Participation Rate have improved for both females and males in India

2. Labour Force Participation Rate have improved in both rural and urban areas

Which of the following statements is not correct regarding SARFAESI Act?

Answer Given: SKIPPED

Explanation:

Option A and D >> Correct

• The Act empowers Banks and Financial Institutions to recover their non-performing asset

(NPAs) without the intervention of the Court.

• Methods for recovery of non-performing assets under the Act

• Securitization: Securitization is the practice of pooling together various types of debt instruments (assets) such as mortgages and other consumer loans and selling them as bonds to investors.

• Asset Reconstruction: Asset reconstruction is the activity of converting a bad or non- performing asset into performing asset with the help of Asset reconstruction companies.

• The Act gives the procedures for the transfer of NPAs to asset reconstruction companies for the reconstruction of the assets.

• Enforcement of Security without the intervention of the Court. If the borrower defaults, the bank may enforce security interests by:

a. Take possession of the security

b. Sale or lease or assign the right over the security

c. Appoint Manager to manage the security

d. Ask any debtors of the borrower to pay any sum due to the borrower.

Option B >> Correct

• In 2020Supreme Court held that Co-operative banks established under a State law and multi- State level co-operative societies also come within the ambit of the SARFAESI Act of 2002.

Option C >> Incorrect

• The Act is effective only against secured loans where banks can enforce the underlying security. The Act is not applicable to unsecured creditors.

In the context of employment scenario in India, consider the following statements:

1. Self-employed persons constitute highest share in India’s total workforce

2. Share of casual laborers in India’s total workforce is drastically increasing over the last few years

3. The number of self-employed persons is much higher in agriculture as compared to non- agricultural enterprises

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1>> Correct,

Statement 2>> Incorrect

Statement 3>> Correct

• The number of self-employed persons was much higher in agriculture as compared to non- agricultural enterprises. Of the total self-employed persons >> 75%per cent are engaged in agriculture and25 per cent in non-agriculture sectors. The number of self-employed persons showed a big increase in both agriculture and non- agriculture sectors since 2017–18

In the context of government spending in India, consider the following statements:

1. Union Government’s capital expenditure as a percentage of GDP shows an upward trend over the last decade

2. Grant given to State Governments or Union Territories by the Union Government is treated as Capital Expenditure

Which of the statements given above is/are correct?

Answer Given: SKIPPED

1. Union Government’s capital expenditure as a percentage of GDP shows an upward trend over the last decade

2. Grant given to State Governments or Union Territories by the Union Government is treated as Capital Expenditure

Which of the following best describes the term Authorized Capital in securities market?

Answer Given: SKIPPED

Explanation:

• Authorized capital is the maximum amount of capital that a company is authorized to raisethrough the issuance and sale of securities, such as stocks, bonds, or other financial instruments.

• The authorized capital is specified in the company's memorandum of association and articles of association, which are legal documents that define the company's purpose, structure, and governance.

• In the securities market, authorized capital is an important concept because it sets a limit on the amount of securities that a company can issue and sell to investors. The authorized capital also determines the maximum amount of equity that a company can raise

Consider the following statements:

1. Union Government's fiscal deficit as a per cent of GDP is on a declining trend over the last five years

2. Primary deficit of Union Government is always lower than fiscal deficit.

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

• The fiscal deficit of the Union Government, which reached 9.2 per cent of GDP during thepandemic year FY21, has moderated to 6.7per cent of GDP in FY22PA and is furtherbudgeted to reach 6.4per cent of GDP in FY23

Statement 2>> Correct

• The primary deficit of the Union Government is typically lower than the fiscal deficit becausethe primary deficit only takes into account the government's revenue and expenditure,excluding interest payments on past loans. On the other hand, the fiscal deficit represents the total borrowing required by the government to meet its expenditure, including interest payments.

In the context of Indian economy, the likely consequence of depreciation of Rupee is:

1. Increase in competitiveness of Indian commodities in international market

2. Increase in foreign capital inflow

3. Increase in import bill

Select the correct answer using the codes given below:

Answer Given: SKIPPED

Explanation:

• As the value of Rupee depreciates with respect to other currencies, a product exported from India would cost lesser dollars in foreign market. As a result, export competitiveness increases

>> hence Statement1 is Correct

• Depreciation of rupee make Indian assets, such as stocks, relatively cheaper for foreign investors, leading to an increase in foreign capital inflow into India. Furthermore, a weaker rupee can make investments in India more attractive for foreign investors because they can get more Indian rupees for their foreign currency. This can encourage foreign investors to invest in India

>> hence Statement 2 is Correct

• Depreciation means that more local currency is needed to purchase imports. Hence imports

become more expensive>> higher import bill. Hence Statement 3 is correct

With reference to „Pradhan Mantri Kaushal Vikas Yojana?, consider the following statements:

1. The targeted beneficiary of short term training component of the scheme is college students.

2. The scheme will also cover new age courses like Artificial Intelligence, robotics and Internet of Things.

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Key components of PMKVY scheme are:

• Short Term Training, Recognition of Prior Learning, Placement Assistance etc.

• Short term training component of the scheme is applicable to any candidate of Indian nationality who is an unemployed youth or, school/college dropouts.

• College students should not be allowed or enrolled under PMKVY as the Scheme focuses on school/college dropouts.

Statement 2>> Correct

• Budget proposes that the scheme will also cover new age courses for Industry 4.0 like coding, AI, robotics, mechatronics, IOT, 3D printing, drones, and soft skills. To skill youth for international opportunities, 30 Skill India International Centres will be also set up across different States

If the customs duty on import of lithium-ion batteries are increased by the government, which of

the following are the likely impacts?

1. It will discourage manufacturing of lithium-ion batteries in India

2. It may increase India’s trade deficit with China

3. It will reduce government’s direct tax revenue

How many of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 >> Incorrect

• Increasing customs duty on batteries incentives domestic manufacture of lithium ion batteries. However customs duty must be lowered on capital goods/raw materials required for such manufacturing.

Statement 2>> Incorrect

• Majority of lithium-ion batteries imported into India come from China. In 2020-21, China accounted for 77% of India's total lithium-ion battery imports.

• Hence higher customs duty on lithium-ion battery will make imports from China expensive >> lesser imports from China >> hence lower trade deficit.

Statement 3>> Incorrect

• As customs duty is an indirect tax, its increase has no immediate bearing on direct tax revenue.

Consider the following statements:

1. Tax revenue of the Union Government is treated as non-debt revenue receipts

2. Tax revenue is the largest component of revenue receipts

3. GST contributes more than half of the Union Government’s tax revenue

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 and 2 >> Correct

• The Union government's non-debt receipts comprises: Revenue receipts (tax and non-tax) and Non-debt capital receipts

• Generally, tax revenue contributes to the majority revenue receipts. For example following is budget estimate for 2023-24 (figures in lakh crore):

Statement 3 >> Incorrect

•Here is the budget estimate of 2023-24. Please note that GST is only 1/4thof total tax revenue of Union.

In the context of Indian economy, High Powered Money constitutes:

1. Notes and coins in circulation with the public

2. Vault cash of commercial banks

3. Deposits held by the Government of India in RBI

4. Deposits held by commercial banks with RBI

Select the correct answer using the codes given below:

Answer Given: SKIPPED

Explanation:

• The total liability of the monetary authority of the country, RBI, is called the monetary base or high powered money.

- It consists of:

i. Currency (notes and coins in circulation with the public and vault cash of commercial banks)

ii. Deposits held by the Government of India with RBI.

iii. Deposits held by commercial banks with RBI

• If a member of the public produces a currency note to RBI the latter must pay her value equal to the figure printed on the note. Similarly, the deposits are also refundable by RBI on

demand from deposit-holders.

• These items are claims which the general public, government or banks have on RBI and hence are considered to be the liability of RBI.

Which of the following benefits are available to an employer under the “National Apprenticeship Promotion Scheme”?

1. Government will reimburse a certain percentage of stipends provided by employers to apprentice.

2. Employers will be provided subsidy for the purchase of occupational safety equipment

3. Government will provide financial assistance to employers in increasing the coverage of employee

insurance.

Select the correct answer using the code given below:

Answer Given: SKIPPED

Explanation:

The scheme has the following two components

1. Sharing of 25% of prescribed stipend subject to a maximum of Rs. 1500/-per month per apprentice with the employers.

2. Sharing of basic training cost up to a maximum of Rs. 7,500 per apprentice.

Which of the following steps were undertaken as part of 1991 economic reforms in India?

1. Government began the process of disinvestment of its equity in public sector industries

2. Reduction of import duty

3. India moved to a fixed exchange rate system to avoid rupee fluctuations

4. Rupee has been made fully convertible in current account transactions.

How many of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 >> Correct

• 1991 reforms paved way for dis-investment. The government started a restricted process ofdisinvesting its ownership and equity in public sector enterprises instead of going through full

privatization, keeping 51% of the equity and management control.

Statement 2>> Correct

• India followed an import substitution policy since Independence, which aimed at substituting imports with domestic production. In this policy, the government protected the domestic industries from foreign competition through imposing heavy import duty. After 1991reforms import tariff have been reduced drastically. The average amount of customs

duty drastically decreased from 200%to only 65%.

Statement 3 >> Incorrect

• India moved to a market-determined exchange rate system after 1991 reforms. Under the new system, the rupee’s exchange rate against other currencies is determined

largely by market demand and supply. The Reserve Bank of India intervenes occasionally, only for maintaining orderly conditions in the market by curbing excessive volatility

Statement 4>> Correct

•The rupee has been convertible on the current account since 1994, meaning it can be changed freely into foreign currency for purposes like trade-related expenses. Today, the rupee is fully convertible on the current account, allowing it to be converted into other currencies and vice versa for transactions such as export and import of goods and services. But it is only partially convertible on the capital account

With reference to “tax buoyancy” of India, consider the following statements:

1. India was able to maintain its direct tax buoyancy constitently above 1 over the last decade

2. India’s total tax buoyancy is never been negative over the last decade

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 >> Incorrect

• Direct tax buoyancy was consistently above 1.4 (and less than 2.74) in thepost-2002and pre- 2008period.

• After falling during the aftermath of Global Financial Crisis in 2008, it settled to 0.75 in 2011- 12.

• In the subsequent years, collections turned more buoyant to reach 1.27in 2018-19. The 2023-24 Budget assumed this number to be 1, lower than both 2022-23 (1.11) and 2021-22

(2.51).

Statement 2 >> Incorrect

Consider the following statements:

1. Subsidies constitutes largest share in Union Government’s revenue expenditure

2. In any given year, revenue expenditure of Union Government is always greater than capital expenditure

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 >> Incorrect

• Major components of revenue expenditure include interest payments, major subsidies, pay and allowances of government employees, pensions, defense revenue expenditure, and transfers to States in the form of Finance Commission grants, Centrally Sponsored Schemes, etc.

• Interest payments constitutes largest share in Union Government’s revenue expenditure.

•For example: As per BE of 2023-24 >> interest payment is 30.8 % of the total revenue expenditure, and Subsidies accounts for only 10% of Revenue Expenditure.

Statement 2 >> Correct

•In any given year, India’s revenue expenditure is always greater than capital expenditure.

Commodity futures market in India is regulated by:

Answer Given: SKIPPED

Explanation:

•As CII is a non-governmental trade association, it can’t be a ‘regulator’.

• The only possible options are Ministry of Commerce and Industry and SEBI, and aspirants could make guess that SEBI being a regulator of capital market and investment ecosystem in

India, it might be the right answer.

• The Commodity Exchange is a platform to purchase and sell agricultural products, natural resources like iron ore, precious metals etc.

• The concept used in stock exchange and commodity exchanges are the same. For example, derivatives trading occur in both the exchanges.

• The apex body for Commodity futures market in India was Forward Markets Commission which was merged with Securities and Exchange Board of India (SEBI) in 2015.

• The Forward Contracts Regulation Act (FCRA) stands repealed, and the regulation of the commodity derivatives market is shifted to SEBI under the Securities Contracts Regulation Act (SCRA), 1956.

Consider the following statements

1. The consolidated state’s fiscal deficit never crossed 5% of the GDP over the last five years

2. Over the last few years, the actual tax devolution to states by the central government is above the 15th Finance Commission recommendation.

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1>> Correct

Statement 2>> Incorrect

The states’ share of central taxes has been hovering in the range of 29-32 per cent since financial year 2020-21 (FY21), when it should have been 41 per cent in line with the recommendations of the 15th Finance Commission. The states’ share has never been close to 41 per cent due to cess and surcharge imposed by the Centre. According to Finance Commission recommendations, cess and surcharge, which form a part of Central taxes, don't have to be shared with states.

Which of the following contributes to non-tariff barriers in international trade?

1. Import quota

2. Export subsidy

3. Customs duty

4. Health and sanitary regulations

Select the correct answer using the codes given below:

Answer Given: SKIPPED

Explanation:

The major non-tariff barriers include

i. Quotas: Licensing of foreign trade is closely related to quantitative restrictions –quotas -on imports and exports of certain goods. A quota is a limitation in value or in physical terms, imposed on import and export of certain goods for a certain period of time.

ii. Licenses: The license system requires that a state (through specially authorized office) issues permits for foreign trade transactions of import and export commodities included in the lists of licensed merchandises. Product licensing can take many forms and procedures.

iii. Production subsidies: given by government to producers of exportable goods for production of goods and services.

iv. Export subsidies: given in the post-production stage to exporters. These subsidies can distort international trade and create barriers to free trade.

v. Health, sanitary and safety regulations: refers to import restrictions based on minimum standards regarding health and safety.

vi. Packaging requirements

vii. Embargo: Embargo is a specific type of quotas prohibiting the trade. As well as quotas, embargoes may be imposed on imports or exports of particular goods, regardless of destination, in respect of certain goods supplied to specific countries, or in respect of all goods shipped to certain countries. Although the embargo is usually introduced for political purposes, the consequences, in essence, could be economic.

viii. Administrative and bureaucratic delays at the entrance

In the context of debt scenario in India, consider the following statements:

1. Since pandemic induced lockdown Union Government’s total debt has been above India’s real GDP.

2. Internal debt constitutes largest share of Union Government’s public debt

3. Non marketable securities constitutes largest share in Union Government’s total Internal debt

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 >> Incorrect

Statement 2 >> Correct

Consider the following statements regarding GST compensation to states:

1. GST (Compensation to States) Act guarantees all states an annual growth rate of 14 percent in their GST revenue, failing which they will be compensated

2. GST compensation cess is primarily imposed on petroleum products

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 >> Correct

• GST (Compensation to States) Act guarantees all states an annual growth rate of 14 percent in their GST revenue during the period July 2017-June 2022.

•If a state’s GST revenue grows slower than 14percent, such ‘loss of revenue’ will be taken care of by the Centre by providing GST compensation grants to the state.

Statement 2 >> Incorrect

• To provide these grants, the Centre levies a GST compensation cess on certain luxury and sin goods such as cigarettes and tobacco products, pan masala, caffeinated beverages, coal, and certain passenger vehicles.

• The Act requires the Centre to credit this cess revenue into a separate Compensation Fund and all compensation grants to states are required to be paid out of the money available in this

Fund.

Which of the following bench mark rates are fixed by Monetary Policy Committee (MPC)?

1. Repo Rate

2. Cash Reserve Ratio

3. Bank Rate

4. Standing Deposit Facility

How many of the items given above is/are correct?

Answer Given: SKIPPED

Explanation:

Instruments of Monetary Policy:

• Repo rate

• Reverse Repo rate

•Liquidity Adjustment Facility (LAF)

• Marginal Standing Facility (MSF)

• Corridor

• Bank Rate

• Cash Reserve Ratio (CRR)

• Statutory Liquidity Ratio (SLR)

• Open Market Operations (OMOs)

• Market Stabilisation Scheme (MSS)

In the context of Monitory aggregates, “Reserve Money” comprises of:

1. Currency in circulation

2. Currency with the public

3. Bankers deposits with the RBI

4. Time Deposits

Select the correct answer using the codes given below:

Answer Given: SKIPPED

Explanation:

Statement 1and 3>> Correct

About Monetary aggregates

• Monetary aggregates are the measures of the money supply in a country.

• RBI publishes four monetary aggregates on the basis of the balance sheet of the banking sector in conformity with the norms of progressive liquidity: M0 (Reserve Money): M0 is the sum of Currency in Circulation, Bankers’ Deposits with RBI, and ‘Other’ Deposits with RBI M1 (narrow money): M1 is the sum of Currency with the Public, Demand Deposits with the Banking System, and ‘Other’ Deposits with RBI. M2: M2 is the sum of Currency with the Public, Current Deposits with the Banking System, Savings Deposits with the Banking System, Certificates of Deposits issued by Banks, Term Deposits of residents with a contractual maturity up to and including one year with the Banking System, and ‘Other’ Deposits with RBI. M3 (broad money): M3 is the sum of Currency with the Public, Current Deposits with the Banking System, Savings Deposits with the Banking System, Certificates of Deposits issued by Banks, Term Deposits of residents with the Banking System, Call/Term borrowings from ‘Non- depository’ financial corporations by the Banking System, and ‘Other’ Deposits with RBI.

What are the economic impacts of rising government bond yield in India?

1. Reduced borrowing cost for corporates

2. Increase in government's expenditure

3. Push for private investment in the economy

How many of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1>> Incorrect

• Government bonds are considered a benchmark for interest rates in the economy. When bond yields rise, the cost of borrowing for corporates also goes up as lenders demand a higher return

Statement 2>> Correct

• Higher bond yields may put pressure on the government's expenses >>as govt will have to pay higher interest on its borrowings

Statement 3 >> Incorrect

• Higher bond yields may lead to a reduction in investment, as investors may choose to invest in safer government bonds instead of riskier assets like equities. This could lead to a decrease in investment in the economy, which could slow down economic growth.

Which of the following statement best describes the term “Inflationary Gap”?

Answer Given: SKIPPED

Answer Explanation:

• An inflationary gap measures the difference between the current level of real gross domestic product (GDP) and the GDP that would exist if an economy was operating at full employment (i.e anticipated GDP).

• The current real GDP must be higher than the potential GDP for the gap to be considered inflationary.

• An inflationary gap exists when the demand for goods and services exceeds production due to higher levels of employment, increased trade activities, or elevated government expenditure. The real GDP can exceed the potential GDP, resulting in an inflationary gap.

• Policies that reduce an inflationary gap include: Reductions in government spending, tax increases, bond and securities issues, interest rate increases, and transfer payment reductions. A government may use fiscal policy to help reduce an inflationary gap by decreasing the number of funds circulating within the economy. A tight monetary policy should lower the money available to most consumers, triggering less demand.

With reference to trading of government securities in India, consider the following statements:

1. RBI owns majority of central government’s dated securities

2. Foreign banks cannot buy government securities in secondary market

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1 >> Incorrect

• In India, Government issues several types of G-secs: Treasury Bills, Cash Management Bills (CMBs), Dated Government Securities, State Development Loans, Treasury Inflation Protected Securities (TIPS), Zero-Coupon Bonds, Capital Indexed Bonds, Floating Rate Bonds.The most common type of security is the dated government security, issued by the central government.The ownership pattern of Central Government dated securities indicates that the share of commercial banks is highest with 35-40%per cent over last few years. Share of RBI and insurance companies are 15% and 25% respectively.

Statement 2 >> Incorrect

•The secondary market for government securities is open to all types of investors, including foreign

banks.

In the context of Non-Performing Assets (NPA) in the banking sector of India, consider the following statements:

1. Asset quality of Scheduled Commercial Banks has been improving steadily over the years across all major sectors

2. Since the global financial crisis of 2008, Private Sector Banks have higher NPA levels compared to Public Sector Banks.

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1>> Correct

• The asset quality of SCBs has been improving steadily over the years across all major sectors. The GNPA ratio has decreased from 8.2 per cent in March 2020 to a seven year low of 5.0 per cent in September 2022, while Net Non-Performing Assets (NNPA) have dropped to a ten-year low of 1.3 per cent of total assets.

Statement 2 >> Incorrect

• Public sector banks have a disproportionate share of NPAs. A large fraction of the difference between NPAs in the public and private sector banks arose due to differences in their business models. Because at the beginning of the 2010s, public sector banks had significantly higher exposure (percent of total loans) to commodity-sensitive sectors such as iron and steel and textiles compared to private sector banks.

Which of the following is/are the functions of the EXIM Bank of India?

1. Financing of export and import of goods and services

2. Rating credit worthiness of exporters and importers

3. Overseas investment finance

Select the correct answer from the code given below :

Answer Given: SKIPPED

Explanation:

Statement 1 >> Correct

• EXIM Bank provides financial assistance to Indian exporters and importers by offering a range of credit facilities like pre-shipment credit, post-shipment credit, buyer's credit, and supplier's credit.

Statement 2 >> Incorrect

• Rating credit worthiness of exporters and importers is not performed by the EXIM Bank of India. Credit rating agencies like CRISIL, ICRA, and CARE provide credit ratings to exporters and

importers based on their creditworthiness.

Statement 3>> Correct

•EXIM Bank of India provides financial assistance to Indian companies for their overseas investment projects through direct loans, lines of credit, and guarantees. This helps Indian companies to expand their business and explore new markets abroad.

Which of the following is the correct sequence of stages of the budget presentation in Parliament?

1. Voting on demands for grants

2. Passing of appropriation bill

3. Scrutiny by departmental committees

4. Passing of finance bill

Select the correct answer using the codes given below:

Answer Given: SKIPPED

Explanation:

Stages of budget presentation

Presentation of budget: The Finance Minister presents the General Budget with a speech known as the ‘budget speech‘. General discussion: During this stage, the Lok Sabha can discuss the budget as a whole or on any question of principle involved therein but no cut motion can be moved nor can the budget be submitted to the vote of the House. Vote on account: The Appropriation Bill and Finance Bill are presented in the month of February, and they take their own time to become act. In order to keep the Government functioning, the House is asked to vote usually two months’ funds i.e. approximately 1/6th of the total estimated expenditure under various grants. This is called Vote on Account. Scrutiny by departmental committees: The 24 departmental standing committees of Parliament examine and discuss in detail the demands for grants of the concerned ministers and prepare reports on them. These reports are submitted to both the Houses of Parliament for consideration. Voting on demands for grants: In the light of the reports of the departmental standing committees, the Lok Sabha takes up voting of demands for grants. The demands are presented ministry wise. A demand becomes a grant after it has been duly voted. Passing of appropriation bill : An appropriation bill is introduced to provide for the appropriation, out of the Consolidated Fund of India, all money required to meet the grants voted by the Lok Sabha and the expenditure charged on the Consolidated Fund of India. Passing of finance bill: The Finance Bill is introduced to give effect to the financial proposals of the Government of India for the following year. It legalizes the income side of the budget and completes the process of the enactment of the budget.

A foreign investment is considered as „Foreign Direct Investment? in India if:

1. The investment is made in an unlisted Indian company

2. The investment is made in a listed Indian company

3. The investment made is less than 10 percent of the post issue paid-up equity capital of a listed Indian company

Select the correct answer using the code:

Answer Given: SKIPPED

Explanation:

Foreign investment means any investment made by a person resident outside India in capital instruments of an Indian company or to the capital of an LLP. Foreign Direct Investment (FDI) Foreign Portfolio Investment It is the investment through capital instruments by a person resident outside India:

(a) in an unlisted Indian company; or

(b) in 10 percent or more of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company.

It is any investment made by a person resident outside India in capital instruments where such investment is:

(a) less than 10 percent of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company or

(b) less than 10 percent of the paid up value of each series of capital instruments of a listed Indian company.

In the context of insurance sector, consider the following statements:

1. Insurance penetration refers to the ratio of total insurance premiums to Gross Domestic Product (GDP) in a year

2. Insurance density refers to the ratio of insurance premium to the total population

3. Life insurance penetration in India is slightly above the global average.

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1and 2>> Correct

• Internationally, the potential and performance of the insurance sector are generally assessed based on two parameters, viz., ‘insurance penetration’, which refers to the ratio of total insurance premiums to Gross Domestic Product (GDP) in a year and ‘insurance density’, which refers to the ratio of insurance premium to population, i.e.; insurance premium per capita and is measured in US Dollar, as they reflect the level of development of the insurance sector in a country

Statement 3>> Correct

• Insurance penetration in India increased steadily from 2.7 per cent around the turn of the millennium to 4.2 per cent in 2020 and remained the same in 2021. Life insurance penetration in India was 3.2 per cent in 2021, almost twice more than the emerging markets and slightly above the global average.

Which of the following is/are the advantages of using Consumer Price Index as the measure of

inflation?

1. It adjusts for improvements in quality of goods and services.

2. It exactly reflects the buying power of consumers.

3. It provide accurate measure of the buying habits of different demographic groups.

How many of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

•CPI doesn‘t account for the quality of goods and services, but just the prices>> eliminates statement

•CPIdoesn‘t reflect the buying power of consumers or buying habits of different demographic groups.

•It only provides the price rise in the overall basket of goods consumed by the general population>> eliminates statement 2 and 3.

Among the following government schemes, which of them are related to insurance sector?

1. Ayushman Bharat Yojana

2. Pradhan Mantri Suraksha Bima Yojana

3. Pradhan Mantri Vaya Vandana Yojana

4. Pradhan Mantri Fasal Bima Yojana

Select the correct answer using the code given below:

Answer Given: SKIPPED

1. Ayushman Bharat Yojana

2. Pradhan Mantri Suraksha Bima Yojana

3. Pradhan Mantri Vaya Vandana Yojana

4. Pradhan Mantri Fasal Bima Yojana

With reference to „Gross Value Added? at Basic Prices, which among the following statements is/are correct?

1. Gross value added (GVA) represents the sum total of Gross Domestic Product (GDP) without discounting for capital consumption

2. It will include product taxes and product subsidies available on the commodity.

Select the correct answer using the code given below:

Answer Given: SKIPPED

Explanation:

• Statement 1>> Incorrect

Gross Domestic Product (GDP)of any nation represents the sum total of Gross Value Added (GVA)without discounting for capital consumption or depreciation and not the other way around.

• Statement 2>> Incorrect

GDP at market prices = GVA at basic prices + Product taxes-Product subsidies. Hence, GVA doesn‘t include product taxes and subsidies. It is instead accounted in GDP calculation.

Who among the following cannot join the Atal Pension Yojana (APY)?

1. Persons of age above 40 years

2. A citizen who is or has been an income-tax payer

3. Person without a bank account

Select the correct answer using the code given below:

Answer Given: SKIPPED

Explanation:

Statement 1and 3>> Correct

? APY is open to all bank account holders in the age group of 18to 40years

Statement 2>> Correct

? Any citizen who is or has been an income-tax payer, shall not be eligible to join APY

“RESIDEX” or “Housing Price Index (HPI)” is published by:

Answer Given: SKIPPED

Explanation:

• NHB RESIDEX, India’s first official housing price index, was an initiative of the National Housing Bank (NHB) undertaken at the behest of the Ministry of Finance

• National Housing Bank is a wholly owned subsidiary of the RBI.

• RESIDEX currently measures price change in residential housing across 50 cities in India and is slated to capture data from over 100cities, including all state capitals and ‘smart cities’.

In the context of current inflation targeting framework of India, consider the following statements:

1. The inflation target is set by RBI

2. The current upper tolerance limit of inflation target is 4%

3. The inflation targets are revised every two years.

How many of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Statement 1>> Incorrect

• In 2016, Parliament amended the RBI Act, 1934 to change the monetary policy, and introduce an inflation targeting framework.

• As per the new framework, the central government, in consultation with RBI sets:

(i) an inflation target, and

(ii) an upper and lower tolerance level for retail inflation

Statement 2>> Incorrect

• The target has been set at 4%, with an upper tolerance limit of 6%and a lower tolerance limit of 2%.The upper and lower limits indicate that although it is desirable for inflation to be close to 4%, deviation between these limits is acceptable.

Statement 3>> Incorrect

• The target and bands are revised every five years. In March 2021, the existing targets were carried forward.

Arrange the following items in the „Consumer Price Index (CPI) combined? in the ascending order

of their weightage?

1. Fuel and Light

2. Food and beverages

3. Housing

4. Pan, tobacco and intoxicants

Select the correct answer using the code given below:

Answer Given: SKIPPED

Fuel and Light

Housing

Food and beverages

Pan, tobacco and intoxicants

With reference to edible oil import of India, consider the following statements:

1. India meets more than half of its edible oils demand through imports

2. Sunflower oil are procured mainly from Ukraine and Russia

3. Palm oil, which makes up 60 per cent of our total edible oil imports, are mainly procured from South America

Which of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

Surveys points that sudden price surge in sunflower oil in India is due to international price pressures, as India sources majority of sunflower imports from Russia and Ukraine.

Statement 1 >> Correct

Economic Survey 2022-23 points out that India meets 60 per cent of its edible oils demand through imports, making it vulnerable to international movements in prices

Statement 2>> Correct, Statement 3>> Incorrect

Palm oil (Crude + Refined) constitutes roughly around 62%of the total edible oils importedand are imported mainly from Indonesia and Malaysia, while soybean oil (22%) is imported from Argentina and Brazil and Sunflower oil (15%) is imported mainly from Ukraine and Russia.

Which of the following fiscal measures taken by the government helps to bring down the prices of

essential commodities in India?

1. Prohibition of wheat flour exports in 2022

2. Reduction of import duty on masur to zero in 2021

3. Increasing the buffer stock of pulses

4. Distribution of pulses to States and UTs at a discounted rate

How many of the statements given above is/are correct?

Answer Given: SKIPPED

Explanation:

To bring down prices of pulses government must release pulses from the buffer stock (Economic Survey has noted that a calibrated release of pulses from the buffer stock will moderate the prices of pulses in the market).

Statement 1 >> Correct

If wheat flour export are prohibited, more wheat flour available in domestic market >> prices will come down. (Survey notes that on 13 May 2022, wheat flour exports were prohibited in order to prevent a domestic surge in prices.)

Statement 2 >> Correct